Management & Mindset

Employee Education Assistance Program: 5 Benefits and the Cost of Implementation

You’ve got “skill development” and “career advancement” listed as employment benefits on your job ad, right? But are you really delivering on your promise?

An employee education assistance program (EAP) can make sure that you do. An EAP— sometimes called a tuition reimbursement program—enables employers to fund their employees’ higher education courses.

For example, you might choose to fully or partially fund your employees’ undergraduate or graduate degrees, professional development or skills-building courses, or vocational certifications.

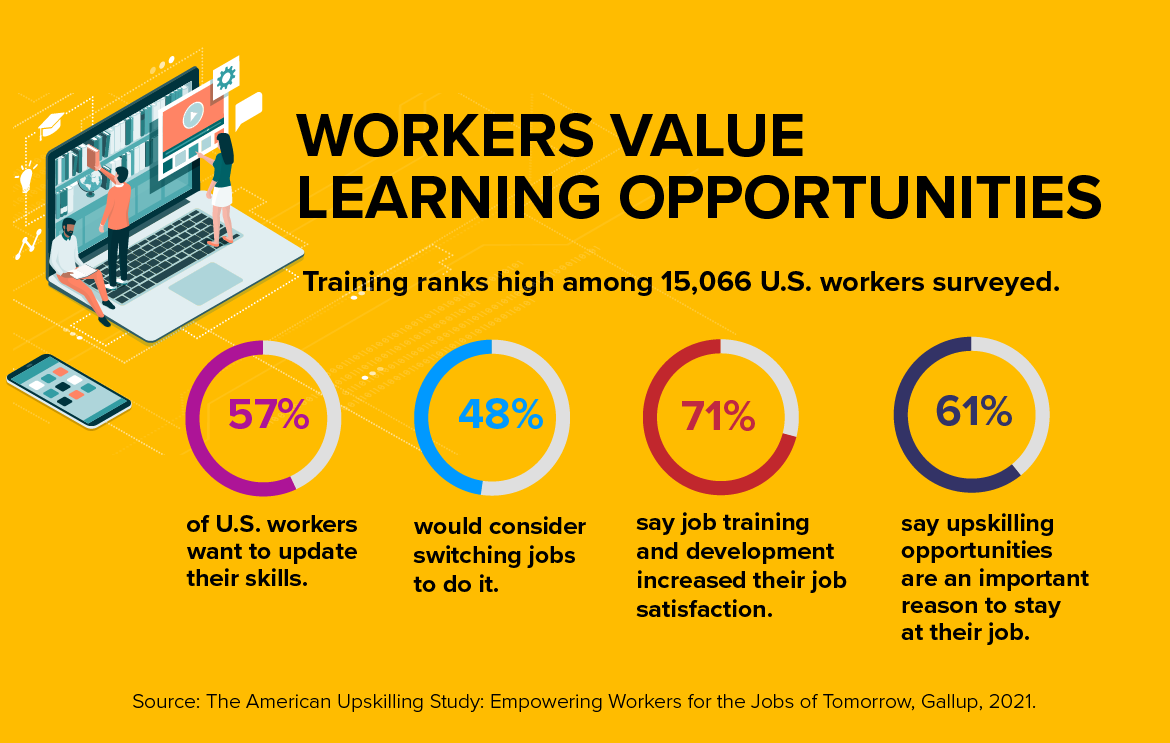

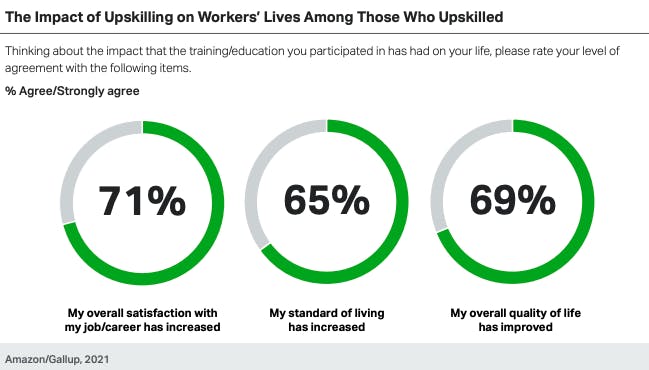

Offering educational assistance to employees is a growing trend for good reason. A recent study by Gallup found that learning and development are top priorities for job seekers and play a key role in the engagement and satisfaction of your current employees. And for your business, EAPs can offer significant returns on investment (ROI).

But are they worth the cost? Before we get into how much EAP costs to implement, let’s explore some of the benefits that make them financially and culturally valuable to your business.

Practical, hands-on learning in 6 simple steps

By downloading, you agree to our privacy policy.

5 benefits of employee education assistance programs

Employee education assistance programs help your employees finance their education, enrich their skills, and pursue their career goals. But EAPs don’t just benefit your employees—they benefit you, too. Here’s how:

1. Improves employee retention rate

You’re probably doing everything you can to locate and hire top talent. But are you doing everything it takes to retain them?

ICMS’s workforce report found that three out of four business leaders say retaining talent is a more pressing challenge than hiring talent. This is hardly surprising—hiring talent only requires you to meet immediate needs, whereas retaining talent requires you to consistently meet your employee's long-term needs.

And what are your employee’s long-term needs? Learning, development, and internal mobility (to name just a few).

Employees want to learn new skills that help them progress within the workplace. In fact, according to the study by Gallup, 48% of workers would switch jobs for an upskilling opportunity.

By offering an employee education assistance program, you cultivate a skills-based growth culture that meets your employee’s long-term development needs. As a result, employees are more likely to grow and thrive within your workplace instead of seeking new opportunities elsewhere.

2. Boosts recruiting efforts

According to ICMS, 78% of job seekers are looking for companies that provide some sort of formal training program. So, offering an EAP can do more than help you meet the average job seeker’s needs.

It can help you become a talent magnet.

The allure of an EAP is powerful. Boasting flexibility, prestige, and long-term value, EAPs attract motivated, passionate, growth-focused talent to your business. This improves the quality of your workforce from the onset, helping to create a culture of learning and development.

And don’t forget, the more upskilled talent you have—the easier it is for you to fill roles through internal recruiting.

3. Corporate tax savings

Tax savings are another EAP benefit that both you and your participating employees can take advantage of.

Under US federal tax law dictated by the Internal Revenue Service (IRS), employers with a qualifying EAP can request a tax deduction of up to $5,250 per year, per employee. Employees can also enjoy the same tax reimbursements of up to $5,250, covering expenses like books, tuition, supplies, etc.

In the UK, there are a number of tax-efficient ways to provide an EAP. One of the most popular is through an employer scholarship scheme, which must be available to all employees. It enables you to fully or partially fund your employee’s education and receive tax deductions.

You can also offer an EAP as part of a remuneration package (often referred to as “benefit-in-kind” in the UK). This means that you pay the full fee and receive a corporate tax deduction.

If you’re not sure where to start, self assessment software for individuals and businesses can help you manage your tax information and send accurate, timely tax returns to receive the relevant tax deductions.

4. Improves employee engagement and satisfaction

Unengaged employees are less productive, less motivated, and less satisfied. Staying in the same uniform position year after year can become incredibly boring.

An EAP might just be the answer to curing long-term talent boredom. The program encourages employees to learn new skills, pursue their passions, and realize new goals, in turn revitalizing their thirst for life both in and outside of the workplace.

5. Enhances employee skills

Your employees want to level up their skills more than you might think.

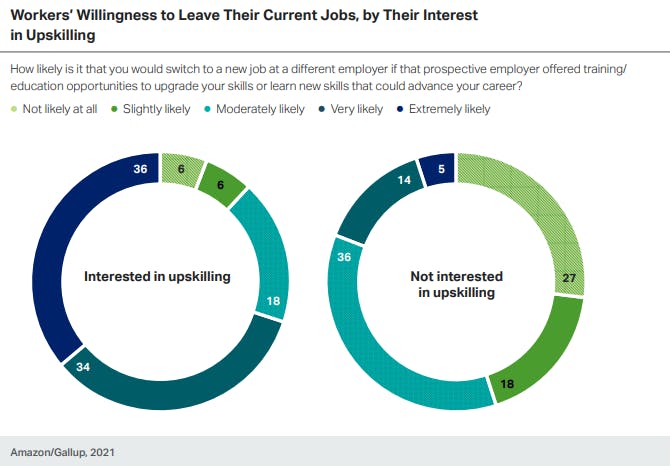

According to the Gallup survey we mentioned earlier, 70% of employees interested in upskilling are either “extremely likely” or “very likely” to leave their current job for a prospective employer with upskilling opportunities.

And when it comes to those who aren’t interested in upskilling, the results are even more telling. A huge 50% admit that they would be “very likely” or “moderately likely” to leave their current role to pursue an upskilling opportunity with a different employer.

So, enhancing your employees’ skills with an EAP helps you retain talent. However, there’s more to it than that.

An EAP is a foundational part of your internal employee mobility strategy. Discuss internal opportunities for career advancement with your employees and help them find courses that give them the skills they need to reach their goals.

The tax implications of employee education assistance

As we mentioned earlier, corporate tax savings are a valuable benefit of employee education assistance programs.

Under section 127 of the US Internal Revenue Code, employers can take $5,250 as a tax deduction per employee, per year. Employees can take the same amount if enrolled in a qualifying EAP. This means that employees don’t need to declare education reimbursements up to the $5,250 cap.

All of the above is subject to the following IRS criteria:

- The employer must have a detailed, written EAP plan.

- The EAP benefits are purely education-based (they must not cover travel, lodgings, food, or any courses relating to irrelevant hobbies or interests).

- The maximum amount of tax deducted from a single employee cannot exceed $5,250 per year, even if they have multiple employers.

In the UK, tax on work-related training can be reimbursed under section 250 ITEPA 2003, whether the employer pays for the training or is reimbursing an employee.

The training must be directly related to the employees’ current position or a position they will likely hold in the future. It will not be eligible for a reimbursement if the aim of the training is to reward the employee or if it is for leisure purposes.

How to provide employee educational assistance with an EAP

There are several different methods that you can use to provide educational assistance. Whether you choose to incorporate one or several of these methods into your program, always consult a tax advisor to ensure that you still get the tax deductions you desire.

Tuition reimbursement

A popular choice for employers is to exclusively reimburse tuition fees. This means that your reimbursements won’t cover additional expenses such as electronics, books, internet service, etc.

Direct payment

You can pay the institution directly upon your employee’s registration for the course. The other option is to pay your employee directly upon registration.

Scheduled payments

To eliminate the risk of paying for a class that doesn’t get completed, you can schedule payments upon course completion. With this agreement, employees pay upfront for their classes, and you reimburse them after they’ve completed the class and submitted an EAP reimbursement form.

Alternatively, you can schedule payments to the institution.

Exclusive institutional partnerships

While you can reimburse classes from any accredited institution, why not approach an institution of your choice and enter an exclusive partnership?

Partnering with an education provider can benefit you and the institution you’ve partnered with. This can increase your brand awareness and credibility in the desirable graduate market, attracting fresh new talent to your business. And for the education provider, it brings in new learners.

Of course, in this situation, you would only reimburse classes that are offered under the official partnership.

Grade dependent payment

Employers also have the option of offering reimbursements based on the employee’s final grade. There are several ways to do this, the most popular being through tiered grade-dependent payments. This strategy can incentivize students to work hard and perform their best in external education programs.

For example, you could opt to reimburse 100% for an “A,” 80% for a “B,” 60% for a “C,” and so on. Or, you could reimburse passing grades exclusively at 100%. The choice is yours; just make sure that you’ve made these grade requirements clear to your employees.

Course dependent payment

You can decide to only pay for certain types of courses (i.e., courses that are relevant to the employee’s current position or alternative internal roles). This is advisable if you want to upskill your employees to help them advance within your business.

Note that in the UK, course-dependent payment is not as flexible of an option. All training must be directly related to an employee's current or future position.

How much will an EAP cost your business?

The decision to create an employee educational assistance program is heavily dependent on your training budget priorities, upfront costs, and overall ROI.

A variety of different factors will affect the cost of your EAP, including:

- The cost of tuition: It goes without saying that higher education classes and degrees can vary by institution and type.

- The tax impact of an EAP: Tax savings can have substantial financial benefits for your business and considerably lower the cost of EAPs. If you’re struggling to calculate your taxes, consider using an online accounting or bookkeeping software. Businesses operating in the UK can learn more about how to make tax digital with Sage to automate processes and get 360-degree visibility into their tax situation.

- Retention rates and turnover costs: If you’re struggling to retain employees or have high turnover costs, the ROI of an EAP has significant potential.

- New hire recruitment: In the same vein, you can reduce the cost of hiring new talent by introducing an EAP into the list of your company’s benefits.

- The opportunities for growth in your business: Upskilling your current employees is less expensive than hiring new employees, according to 79% of learning and development pros. Analyze your business for skills gaps and weigh up the costs of internal vs. external recruitment.

The takeaway

If you’re on the hunt for high-quality talent, an employee educational assistance program can help you stand out from the crowd. Not only do they attract passionate prospective talent, but they ensure that this talent thrives long-term within your company.

And for companies that are currently experiencing hiring freezes or budget cuts, doing more with less is key. A comprehensive learning management system and learning experience platform like 360Learning empowers and enables your internal subject matter experts to help your existing talent upskill from within. L&D teams are no longer limited to looking externally for scalable employee training content and programs.

So, what does all this mean for your business? It means there is now a growing number of ways to attract, create, and support a workforce of loyal, highly-skilled employees–and that in turn translates to excellent employee retention rates, fewer skills gaps, and foundational cost savings.